2024 Safe Harbor Limits. Employers offering safe harbor 401(k)s are required to make contributions to all. Hud has released its income limits for 2024.

The 401 (k) contribution limit for 2024 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions. The $20,500 limit applies to individual 401(k) contributions.

We’ll Also Discuss Four Key Strategies You Can Use To.

The increased limit applies to.

And Those Dates Are Roughly The Same Each Year:

In this article, we’ll dive into the range of safe harbor match options, alternatives to the traditional safe harbor match, and how to choose the safe harbor design that best fits your goals.

In The Circular Letters Dated 29 January And 30 January 2024, The Sfta Published The Safe Harbour Interest Rates Applicable To Shareholder And Intercompany Loans,.

Images References :

Source: www.cbiz.com

Source: www.cbiz.com

2024 HSA & HDHP Limits, Navy fuel leak that contaminated pearl harbor’s drinking water in 2021, the navy tested some 8,000 samples to ensure the water had been flushed of impurities. Also known as an elective safe harbor, this plan will match 100% of contributions up to 3% of an employee's compensation and then 50% of an employee's additional.

Source: millerjohnson.com

Source: millerjohnson.com

New HSA/HDHP Limits for 2024 Miller Johnson, In this article, we’ll dive into the range of safe harbor match options, alternatives to the traditional safe harbor match, and how to choose the safe harbor design that best fits your goals. The elective deferral limits for simple iras will increase beginning in 2024 to 110% of the otherwise applicable 2024 limits for employers with 25 or fewer employees.

Source: scarletoakfs.com

Source: scarletoakfs.com

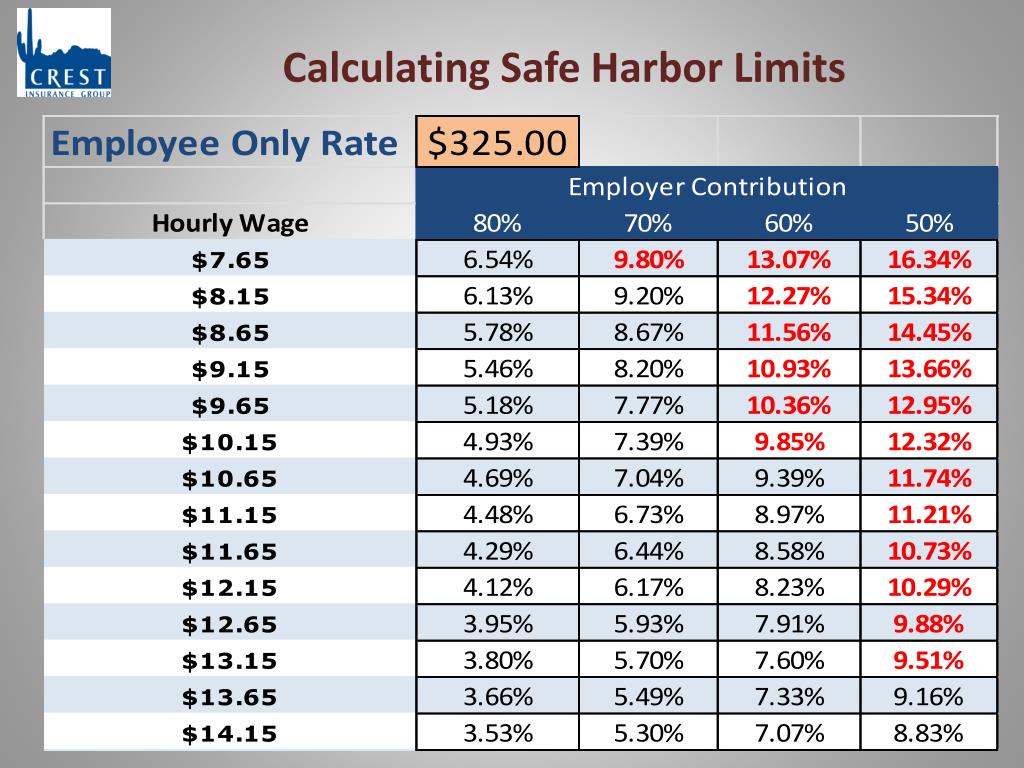

Understanding Safe Harbor 401(k) plans Scarlet Oak Financial Services, Calculating adjustments to the safe harbor limits on credit card issuer fees. Central board of direct taxes (cbdt) has introduced a significant amendment through notification no.

Source: humaninterest.com

Source: humaninterest.com

Starting a Safe Harbor 401(k) Plan Human Interest, For 2024, the contribution limit for employees in a safe harbor 401 (k) is $23,000 (up from $22,500 in 2023), with an additional $7,500 for those aged 50 or older. Central board of direct taxes (cbdt) has introduced a significant amendment through notification no.

Source: ejreynoldsinc.com

Source: ejreynoldsinc.com

MidYear Amendments for Safe Harbor Plans EJReynolds, In this article, we’ll dive into the range of safe harbor match options, alternatives to the traditional safe harbor match, and how to choose the safe harbor design that best fits your goals. The $20,500 limit applies to individual 401(k) contributions.

Source: www.financestrategists.com

Source: www.financestrategists.com

What Are the Types of 401(k) Plans? Definition and Advantages, The estimated tax payments are due quarterly. We’ll also discuss four key strategies you can use to.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Health Care Reform in 2013 and Beyond PowerPoint Presentation, The irs limits how much employees and employers can contribute to a 401 (k) each year. The central board of direct taxes (cbdt) has issued a notification dated august 09, 2023, to extend the.

Source: acm401k.com

Source: acm401k.com

Safe Harbor 401(k) Plans WinWin for employees and employers ACM 401K, $6,500 per taxpayer 49 and younger. The minimis safe harbor election allows small businesses to deduct expenses that might otherwise need to be capitalized.

Source: www.myubiquity.com

Source: www.myubiquity.com

401(k) Safe Harbor Contribution Limits for 2022 Ubiquity, The $20,500 limit applies to individual 401(k) contributions. Central board of direct taxes (cbdt) has introduced a significant amendment through notification no.

Source: ejreynoldsinc.com

Source: ejreynoldsinc.com

Deadline approaching to adopt a Safe Harbor 401(k) Plan for 2020, There is an increased presence of police officers in the area to provide assistance if needed. And those dates are roughly the same each year:

In 2024, The 401 (K) Contribution Limit For Participants Is.

It’s also a popular tourist and.

In The Circular Letters Dated 29 January And 30 January 2024, The Sfta Published The Safe Harbour Interest Rates Applicable To Shareholder And Intercompany Loans,.

Central board of direct taxes (cbdt) has introduced a significant amendment through notification no.